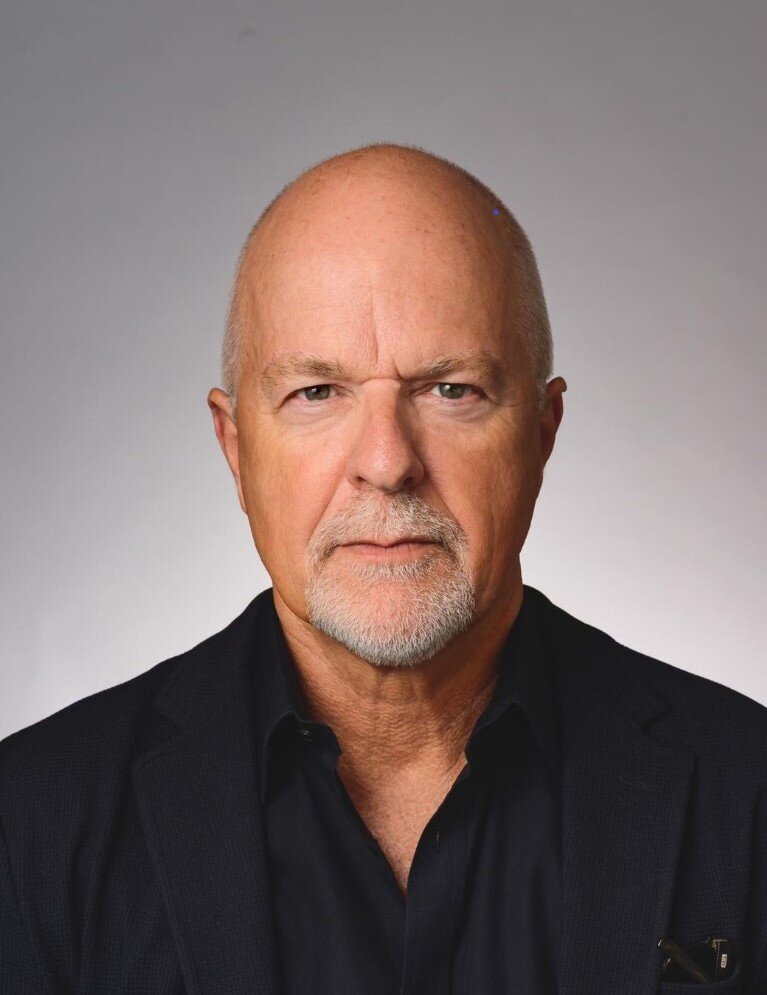

CHRIS MATHERS, BA, CFE

Phone: (416) 451-8061

Email: chris@chrismathers.com

In 1995, following a twenty year career with the Royal Canadian Mounted Police, Chris joined the Forensic division of the international accounting firm, KPMG.

In 1999, he was appointed to the position of President of KPMG Corporate Intelligence Inc. where he was responsible for international due diligence, asset recovery operations and the investigation and prevention of organized crime, money laundering and terrorist financing.

In May 2004, Chris established CHRIS MATHERS INC., a private crime and risk consulting firm in Toronto, Canada. Some of the company’s most recent assignments have been:

Providing technical assistance, mentoring and training to the Nigerian government’s anti-corruption agencies on behalf of the UK government’s Justice For All Program.

Independent testing of Anti-Money Laundering/Terrorist Financing (AML/TF) practices and creation of appropriate compliance programs at numerous Canadian and foreign financial institutions.

Designing and delivering training on AML/TF to domestic and foreign financial institutions.

Conducting an offshore asset tracing and money laundering investigation on behalf of the Independent Inquiry Committee into the United Nations Oil-For-Food Programme.

Providing expert evidence on behalf of a Canadian financial institution at the Federal Competition Tribunal on money laundering/terrorist financing practices.

Chris is a popular media commentator and speaker on organized crime and terrorism, appearing regularly in Canada and the US major media outlets. He has served as a consultant on several feature films and documentaries relating to organized crime, espionage and money laundering. He is the author of the bestselling non-fiction book, CRIME SCHOOL: Money Laundering.

ROBERT ECHEVARRIA

Managing Director - Western Europe and Russia

Robert is responsible for the coordination of investigative due diligence assignments in Western Europe, Russia and the former Soviet republics. He has an extensive background in law, regulatory compliance and asset management. He holds a law degree from the University of Havana and is fluent in Spanish, English and Russian.

In addition, he has business development responsibility for our Information Technology practice, specifically I.T. Security, Forensics and Incident Response.

Robert practised law in Spain from 1994 to 2000, before relocating to the United States to enter private business. He has a significant network of business contacts in Russia, Western Europe, Latin America and the Caribbean.

Robert brings to the company his gifted communications skills and international legal expertise, together with a wealth of business experience in jurisdictions with varied cultural, historical and political backgrounds.

MARK MCKENZIE, MBA

Mark McKenzie is a leading technical expert in the field of regulatory compliance and governance, with primary focus on anti-money laundering/combating the financing of terrorism (AML/CFT). He is a specialist in the development of compliance policies and procedures, compliance evaluations and assessments, and compliance training.

From May 2003 to April 2006 he was the Director of Policy Research & Statistics at the British Virgin Islands Financial Services Commission (BVI FSC). At the FSC, Mark was responsible for the development and implementation of the AML/CFT compliance program in the BVI.

Prior to joining the FSC, Mark was the senior policy research officer at the Cayman Islands Monetary Authority (CIMA). During his time at CIMA, he was instrumental in conducting research to guide the enhancement of Cayman’s AML/CFT regulatory regime.

Most recently, he served as a technical expert for the International Monetary Fund (IMF) and FIRST Initiative's technical assistance program to provide AML/CFT training for Caribbean Insurance Supervisors. Mr. McKenzie has researched and published numerous of articles and papers on regulatory compliance and governance in major journals and newsletters. He is also frequent speaker and moderator at major conferences and seminars on AML/CFT compliance issues. In addition to his technical knowledge, Mark is an excellent leader and coach.

ROBERTO KELSO

Roberto Kelso has been a strategic and operational risk consultant for more than a decade, focusing on internal control, compliance and security. He is currently a business risk advisor to the Audit & Risk Committees of several Latin American companies and international organizations.

Roberto is a former special agent for the U.S. Army & Air Force Exchange Service, in Panama and Honduras. Prior to joining CHRIS MATHERS INC., he was the Forensic Services Director (Central America) at the international public accounting firm, KPMG, where he was responsible for the development and coordination of complex international fraud investigations.

Mr. Kelso has published numerous articles and papers on risk management in major journals and newsletters. He is a frequent speaker and moderator at anti-fraud conferences and seminars and is the founder and President of the Panamanian Association of Fraud Examiners.

WALLY TYKOLIZ

Wally is a career public servant having 30 years of awarded exemplary level, law enforcement service. His law enforcement career began with the Niagara Regional Police Service and included secondments to Royal Canadian Mounted Police (RCMP) as a Subject Matter Expert Investigator in major organized crime projects.

Wally has impressive and vast experience in uniform, tactical, supervisory, detective and intelligence speciality units. He has an expertise in complex fraud, money laundering and defalcation of funds investigations. Wally was recognized for his organized crime investigations, use of physical / electronic investigative methods and techniques that were regional, national and international in scope.

In 2003, Wally continued his civil service at the federal level with the internationally renowned Canadian Security Intelligence Service (CSIS) as a security specialist. His awarded and recognized “Classified” duties in human resources, government employee security clearance and immigration screening clearance included secondments to Department of Foreign Affairs and International Trade (DFAIT), Citizenship and Immigration Canada (CIC) and Canada Border Service Agency (CBSA) as a Subject Matter Expert in Permanent Resident Application / Refugee Immigration Vetting.

In 2017, Wally entered the private sector as a Medical Marihuana Industry Security Consultant and has facilitated in all aspects of Health Canada's Licensed Producer of Medical Marihuana process, "from license to build".

Described as a lifelong student, Wally has completed a multitude of prestigious "classified" employment training and formal education programs.

SUZANNE CREIGHTON

Suzanne Creighton is a senior anti-money laundering auditor and executive consultant in anti-money laundering and counter terrorist financing and sanctions for Canadian, US, UK, EMEA HK, and PAC Asia jurisdictions with over 15 years of compliance experience in Canadian financial institutions. She has extensive experience leading business investigations, carving out controls and designing programs. Suzanne’s experience also includes, acting as a SME for entities seeking letters patent in Canada, drafting policies and procedures, risk assessments, technical reviews, project management, GRC builds and RCM-LCM builds, reviews, and management as well as leading complex AML audits. Suzanne brings broad band of knowledge of subject matter expertise and business acumen.

Suzanne acted as lead on numerous large value projects at various financial institutions and is considered a regulatory subject matter expert for the PCMLTFA and its associated regulations and the application of Canadian sanctions. She is also deemed a subject matter expert on risk assessments and guiding businesses on obligations. She specializes in developing compliance requirements and controls while keeping the business functioning and ensuring compliance with all regulatory rules. She has a deep understanding of the DNA of banking as well as securities and works with executive teams and board members for their mandatory audits and any remediation. In addition to board reporting and any regulatory reporting required, Suzanne has also worked on AML training, regulatory white papers and has experience working with regulators to resolve issues any institution may have or be facing.